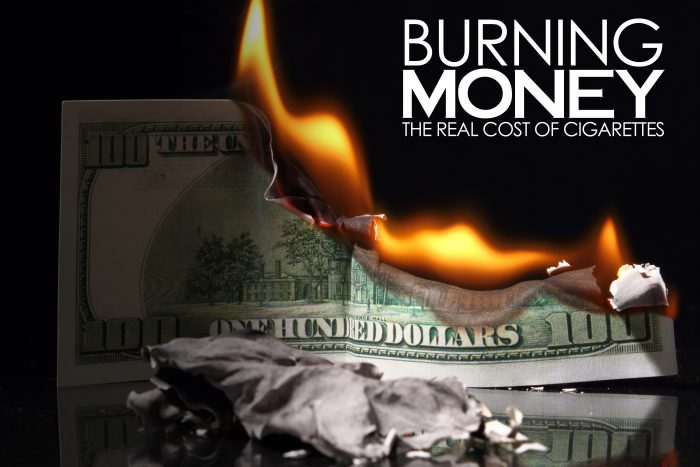

Burning Money

When you light up a cigarette, do you think to yourself, “Man, I wish I had never started smoking”? You also probably hate it when someone else says something judgmental about your addiction. Well, I’m not here to judge you. Maybe your conscience gives you enough grief for your habit already. I’m just here to give you cold, hard facts about how being a smoker impacts your insurance.

The most obvious type of insurance affected is your health insurance. Smoking causes your rates to increase because your risk for disease and cancer increases. Your rates are roughly 20% more than a non-smokers rates. You already knew that. Never mind the health insurance increase.

Let’s focus instead on the less obvious way you have to spend more money on insurance.

Dental care is more expensive for smokers. The smoke damages your teeth and gums, putting you at an increased risk for gum and mouth disease. Smoking is also one of the main causes of tooth loss. All these dental bills can get expensive, so your insurance company will raise your rates to make up for the difference.

Cigarettes are the number one cause of house fires; in America, over 20,000 housefires a year are caused by cigarettes. Because of this fact, your homeowner’s insurance rates are increased.

The higher your claim risk is, the higher your rates are.

By: KayLynn

By: KayLynn

Do you have questions about your insurance? Find an insurance agent near you with our Agent Finder

Search All Blogs

Search All Blogs

Read More Blogs

Flappers, Flights & Fizzy Fridays: The Roaring Twenties You Never Knew

Dive into the 1920s beyond the speakeasies! Explore the decade’s social shifts, technological marvels, and surprising connections to modern times.

Bundle Up and Save! The Ins and Outs of Business Insurance

Unsure about business insurance? Don’t be! Learn how bundling different coverages protects your company and puts money back in your pocket.

Life Insurance Myths Busted: Unveiling the Simple Truths Behind Financial Security

Considering life insurance but confused by the myths? We clear the air on common misconceptions and show you how to get simple, affordable coverage.

Buckle Up for Savings: How Car Safety Ratings Save You Money

Crash Test Your Cash Flow: How Car Safety Ratings Impact Insurance Rates

Pool Paradise or Premium Pain? The Splashing Truth About Pool Insurance

Dive into Savings: How Pools Affect Homeowners Insurance (and How to Stay Afloat)

Lights, Camera, Action! Exploring the Real-World Locations of Your Favorite Films

Exploring the Real-World Locations of Your Favorite Films

From PJs to Productivity: Mastering the Work-From-Home Hustle

Ditch the Commute, Keep the Cash: Working From Home Hacks for Peak Performance

The Farewell Financial: Planning a Peaceful Goodbye

Beyond Goodbyes: A Guide to Navigating Funeral Costs and Life Insurance

From Death Traps to Death Beaters: How Cars Became Surprisingly Safe

Buckle Up and Breathe Easy: Unveiling the Hidden Heroes of Car Safety

Cracking the Condo Code: Your Guide to Condo Insurance

Condo Confusion Conquered! A Guide to Condo Insurance Coverage