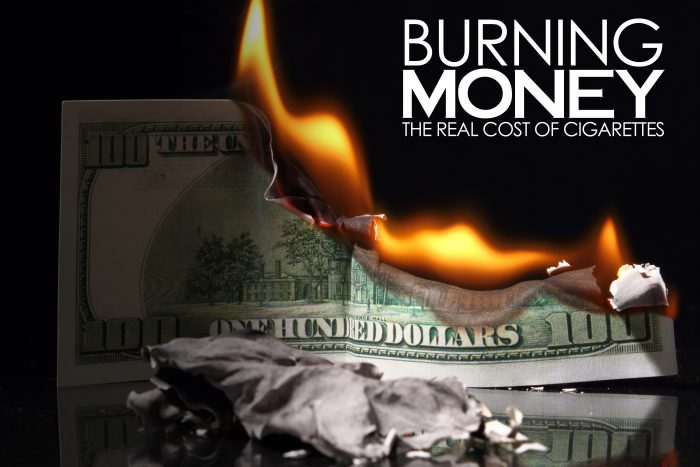

Burning Money

When you light up a cigarette, do you think to yourself, “Man, I wish I had never started smoking”? You also probably hate it when someone else says something judgmental about your addiction. Well, I’m not here to judge you. Maybe your conscience gives you enough grief for your habit already. I’m just here to give you cold, hard facts about how being a smoker impacts your insurance.

The most obvious type of insurance affected is your health insurance. Smoking causes your rates to increase because your risk for disease and cancer increases. Your rates are roughly 20% more than a non-smokers rates. You already knew that. Never mind the health insurance increase.

Let’s focus instead on the less obvious way you have to spend more money on insurance.

Dental care is more expensive for smokers. The smoke damages your teeth and gums, putting you at an increased risk for gum and mouth disease. Smoking is also one of the main causes of tooth loss. All these dental bills can get expensive, so your insurance company will raise your rates to make up for the difference.

Cigarettes are the number one cause of house fires; in America, over 20,000 housefires a year are caused by cigarettes. Because of this fact, your homeowner’s insurance rates are increased.

The higher your claim risk is, the higher your rates are.

By: KayLynn

By: KayLynn

Do you have questions about your insurance? Find an insurance agent near you with our Agent Finder

Search All Blogs

Search All Blogs

Read More Blogs

Beyond Boredom: Unearthing the Surprising Stories Behind Our Favorite Board Games

Game night secrets revealed! Discover the surprising origins and quirky facts behind your beloved board games.

Avoiding the Pitfalls: Common Mistakes of At-Home Businesses

Launch your home business right! Learn to avoid the common errors that can derail your entrepreneurial dreams.

Your Life Insurance Recipe: Crafting the Perfect Blend for Your Family’s Future

Find your perfect life insurance mix: Learn how to blend term and permanent policies for optimal family protection.

From Ford’s Innovation to Today’s Marvel: Unveiling the Secrets of Modern Car Production

Beyond the assembly line: Discover the surprising speed, customization, and quality checks involved in modern car manufacturing.

Beyond Pizza and Promises: Recognizing When It’s Time to Hire Professional Movers

Time to call the pros? Learn when pizza and beer just won’t cut it for your next move.

Mapping Our Roots: Uncovering the Stories Behind American City Names

City names revealed! Discover the historical, religious, and geographical influences behind the monikers of American cities.

The Agile Approach: Why Short, Focused Plans Are Overtaking the Mammoth Business Blueprint

Ditch the doorstop plan! Discover why concise, adaptable strategies are the new gold standard for business success.

Embracing Tomorrow: The Practical Power of Planning for Life’s Only Certainty

Face the future with confidence: Understand how planning for life’s only certainty with life insurance can provide lasting security.

Steering Your Savings: Taking Control of Your Car Insurance Rates

You’re in the driver’s seat! Learn how your credit, driving habits, vehicle choice, and smart shopping can lower your car insurance costs.

Underfoot Upgrade: Transforming Your Garage Floor from Forgotten to Fantastic

Don’t ignore your garage floor! Discover easy and impactful ways to upgrade this often-neglected area of your home.