Sharing Your Ride? Make Sure You’re Covered.

Sharing Your Ride? Make Sure You’re Covered.

Ridesharing services have grown dramatically in the past several years. Although precise numbers are hard to come by, it is estimated there are about two million rideshare drivers in the U.S. alone. It is thought that about two-thirds of these drive for both major providers, Uber and Lyft. If you or someone you know drives for one of these companies, you may feel you are adequately covered by the companies own insurance policies. That could be a mistake.

If you have Uber or Lyft insurance, it generally covers you based on “periods” or “phases”. In Phase 0, when your app is turned off, your personal insurance policy covers you. In Phase 1, when the app is on, your personal policy without ridesharing coverage doesn’t protect you. Uber and Lyft coverage is liability only during this time. Once a request is accepted in Phase 2, the driver is covered fully by Uber and Lyft coverage. This full-coverage continues while a passenger is in the vehicle, or through Phase 3.

To make sure you are fully covered as a rideshare driver, it is recommended you consider additional ride-sharing coverage. This ride-sharing coverage will cover you for any gaps in the ride-sharing company’s coverage and ensures you stay on the straight and narrow with your personal insurance provider. You don’t want to experience an accident and then tell your personal auto insurance company you were driving for Lyft or Uber. The good news is that rideshare insurance is relatively inexpensive. In fact, you’ll likely be able to pay for it with what you earn in one or two rides. That little investment can be worth it in peace of mind alone.

Ride-sharing insurance coverage is far cheaper than commercial insurance, which would likely cost $100 monthly or more. If you drive for a ride-sharing company, let your auto insurance company know. Have them review your personal auto policy and see how they can cover those gaps with a ride-sharing policy.

Driving for a ride-sharing company can be a good way to pick up some extra cash. Some drivers have decided to make driving their full-time job. Whether you drive on the occasional weekend or every day, take the steps to make sure you are not at risk. Contact us for a no-cost, no-obligation auto insurance review today!

Do you have questions about your insurance? Find an insurance agent near you with our Agent Finder

Search All Blogs

Search All Blogs

Read More Blogs

South America: Beyond the Basics

Surprising South America: Fun Facts, Hidden Gems, and Unexpected Trivia (You Won’t Believe #7!)

She Means Business: Powerful Women Who Built Billion Dollar empires

Conquering the Corporate Jungle: Inspiring Women-Led Businesses You Should Know (Free Business Insurance Quote!)

Your Life Insurance Policy: A Secret Savings Account?

Don’t Cash Out! Unlock the Hidden Benefits of Your Life Insurance Policy (Free Quote Included!)

Don’t Be a Drain! The Essential Fluids Your Car Needs to Flow

Car Care 101: Essential Fluids Explained (Don’t Get Stuck on the Side of the Road!)

How to Maximize Your Chances of Getting Your Security Deposit Back

Moving Out? Don’t Leave Your Money Behind! Get Your Security Deposit Back Every Time (and Maybe Even Renters Insurance!)

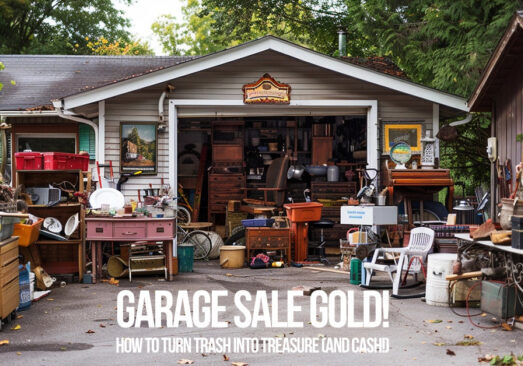

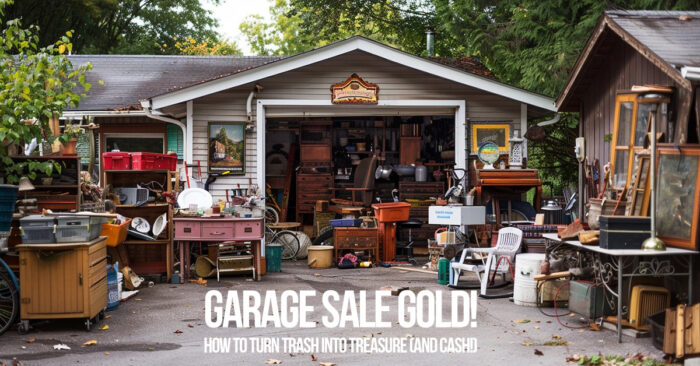

Garage Sale Gold! How to Turn Trash into Treasure (and Cash!)

Don’t Trash It, Sell It! Pro Tips for a Successful Garage Sale (and Extra Cash!)

Don’t Let Your Business Go Up in Smoke! Top 5 Causes of Commercial Fires (and How to Prevent Them)

Commercial Fire Safety: Protect Your Business from the Top Fire Threats (Free Quote Included!)

Taming the Paper Tiger: How to Keep Important Documents Safe

Don’t Let Your Important Documents Become Disaster Snacks! Safe Storage Tips Inside

A Fun Ride Through Auto Racing History (and How to Save on Insurance!)

Need for Speed: A History of Auto Racing in the US (Plus Save on Car Insurance!)

Dive into Safety: Essential Pool Tips for Fun (and Peace of Mind!)

Poolside Paradise or Potential Peril? Top Pool Safety Tips for Families