How Your Life Can Be Easier and Cheaper with IoT

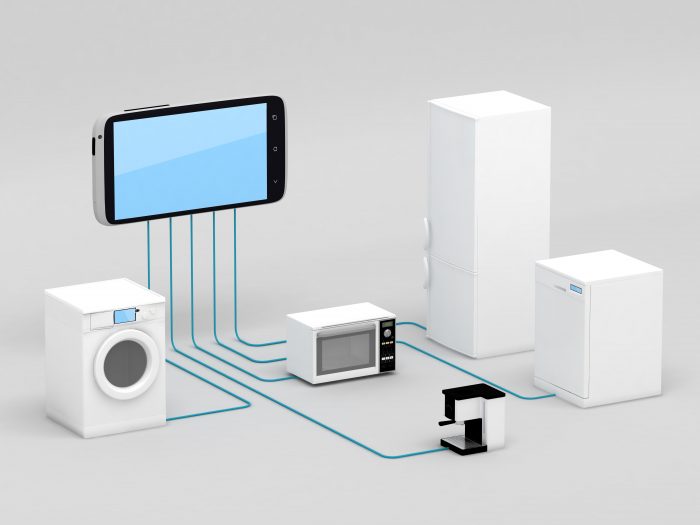

Internet of Things Concept – Home Appliances Connected To Smartphone

The way of today’s society is about living life in the fast lane and trying to get as much money as you can get your hands on—no, not you, sticky-fingered kleptomaniacs. Imagine devices that collect and transfer information instantly and can also save you money in the long-run. I’m referring to what’s known as IoT, or, the Internet of Things.

What “things”, you may ask? With such a broad title, what “things” are including the internet? It’s anywhere from home-security devices, to a toothbrush. What even is IoT? The Internet of Things uses a system of devices implanted with a technology that senses different aspects of that device’s surroundings and relays that useful information right to your cell phone. This technology can take the details of your everyday life and instantly send those facts to help you improve the quality of your life in many ways.

IoT includes devices that instantly measure carbon dioxide levels to prevent housefires via the smoke detector in your home, and doorbells that enable you to answer your door from your office space and have a face-to-face conversation from work. Also, the toothbrushes that measure the exact surface area of your teeth you are brushing, preventing too many trips to the dreaded-dentist’s office.

By having IoT connected to a security device in your home, with quick-response alarms equipped with built-in cameras that send notifications directly to your smart phone, the risk of emergency situations and burglaries in your home can greatly be reduced. When your agent notices you have preventative devices to protect your home, they are likely to reduce the cost of your home insurance.

Similarly, using an app on your smart phone enabled with UBI, or usage-based insurance telematics, to measure how quickly you stop and accelerate, your speed, even what time you’re driving, can result in discounts on car insurance. Some insurance companies use your driving record to decide how much your insurance is. This depends on how your driving is, rated on a scale from 80-year-old grandma, to absolute maniac. Just kidding, I think the scale involves more numbers.

This form of technology has begun to attach itself to numerous devices we use in our everyday lives, and it will only continue to impact our lives in the future, so let’s use it to our advantage.

By: Kaylynn

By: Kaylynn

Do you have questions about your insurance? Find an insurance agent near you with our Agent Finder

Search All Blogs

Search All Blogs

Read More Blogs

Used Car, New Coverage: Insuring Your Post-Holiday Vehicle Purchase in January

Just bought a used car? Don’t forget to update the VIN, transfer your coverage, and check if you need higher Medical Payments limits.

The Mid-Winter Meltdown: Protecting Your Home from Aging Furnace and Water Heater Failure

Mid-January system failure is costly. Learn why standard home insurance doesn’t cover your broken furnace and why you need an Equipment Breakdown endorsement now.

The Great Indoor Escape: Launching Your Mid-January Reading Challenge

Swap the screen for a spine! How to launch a simple, rewarding mid-January reading challenge to improve focus and beat the winter blues.

Cyber Traps of Tax Season: Securing Your Business Data with Cyber Insurance

Tax season is phishing season. Protect your sensitive financial data and employee W-2s with robust Cyber Insurance coverage against targeted tax fraud.

Tax Season Lifeline: Why January is the Time to Secure Estate Liquidity with Life Insurance

Tax season is here. Use Life Insurance to create tax-free liquidity for your estate and protect your family business from forced asset sales.

The Debt-Deductible Dilemma: Aligning Your Auto Policy with Post-Holiday Finances

Did holiday spending deplete your savings? Reconsider high auto deductibles—you might not be able to afford the out-of-pocket cost if you have an accident now.

Deep Freeze Defense: Essential Home Insurance Prep for January’s Peak Winter Storms

Don’t wait for the blizzard. A mid-January guide to using your Home Insurance to protect against peak winter storm damage, from ice dams to power outages.

Sparks in the Dark: The Shocking Science (and Solutions) of National Static Electricity Day

Why does everything zap you in January? Celebrate National Static Electricity Day by learning the science of the “winter spark” and how to stay grounded.

The Digital Clean Slate: Securing Your Business Cyber Insurance

Digital organization is key. An audit of your cyber policy and MFA security measures is vital to meet 2026 insurance requirements and lower premiums.

The Healthy Policy: Leveraging Your January Wellness Resolutions for Life Insurance Savings

Did you resolve to get healthier? Your improved fitness can translate into lower life insurance premiums in the new year.