The Art of Automotive Customization: A Deep Dive

The Art of Automotive Customization: A Deep Dive

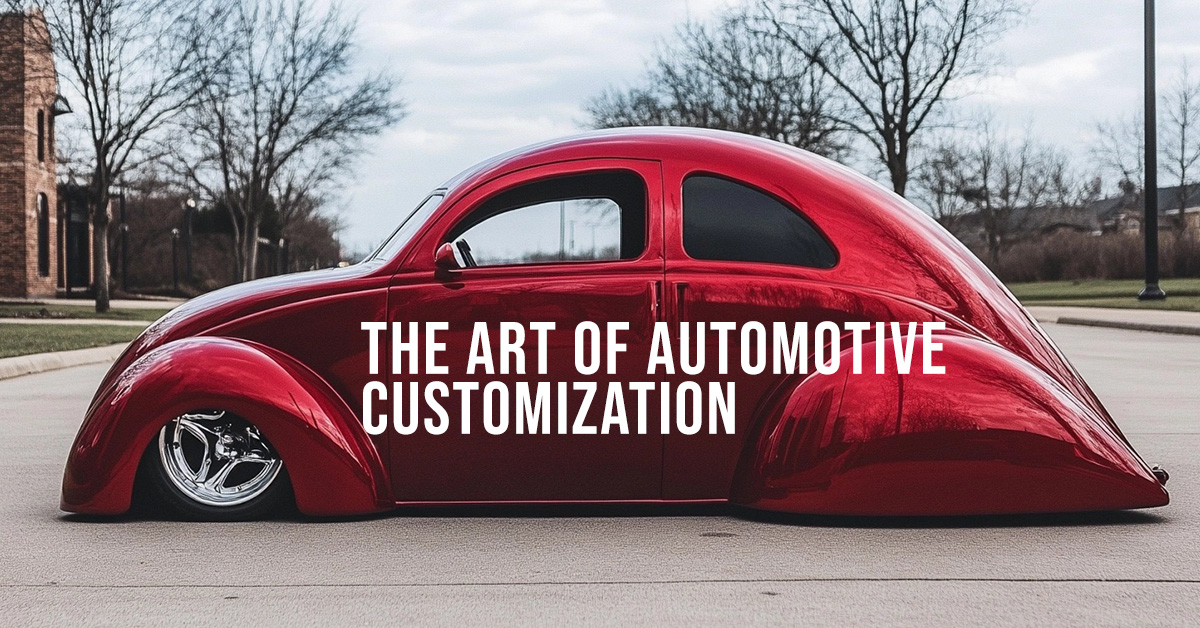

Car customization has always been a popular way for individuals to express their unique style and personality. Over the years, the art of modifying vehicles has evolved, with new trends and technologies constantly emerging. Let’s delve into some of the most popular customization trends and the impact they can have on your vehicle’s value and insurance coverage.

The Wheel Deal

One of the most common ways to customize a car is by upgrading the wheels and tires. Oversized rims, low-profile tires, and custom finishes can dramatically alter a vehicle’s appearance. However, it’s important to consider the practical implications of these modifications. Larger wheels and tires can affect fuel economy, ride quality, and handling.

Sound Systems: A Sonic Experience

High-performance sound systems have become a staple of car customization. Subwoofers, amplifiers, and premium speakers can transform a car’s interior into a concert hall on wheels. While these systems can enhance the driving experience, they can also be costly to install and maintain.

Custom Paint Jobs: A Canvas for Creativity

Custom paint jobs allow car enthusiasts to create truly unique vehicles. From subtle color changes to elaborate airbrush designs, the possibilities are endless. However, custom paint jobs can be expensive and time-consuming. It’s essential to work with a skilled painter to ensure a high-quality finish.

Performance Upgrades: Unleashing the Power

For those seeking increased performance, engine modifications, such as turbocharging, supercharging, and engine swaps, are popular options. These upgrades can significantly boost a vehicle’s horsepower and torque. However, they can also increase fuel consumption and maintenance costs.

The Insurance Implications of Customization

When customizing your car, it’s crucial to consider the impact on your insurance coverage. Many insurance companies require you to disclose modifications, as they can affect the vehicle’s value and risk profile. Some modifications may even void your insurance policy. It’s essential to consult with your insurance agent to ensure you have adequate coverage for your customized vehicle.

By understanding the potential costs and risks associated with car customization, you can make informed decisions and enjoy your modified vehicle without compromising your financial security.

Do you have questions about your insurance? Find an insurance agent near you with our Agent Finder

Search All Blogs

Search All Blogs

Read More Blogs

Let the Good Times Roll—Safely: Mardi Gras Liability for Your Business

Hosting a Mardi Gras party this Tuesday? Make sure your business has the right event liability and liquor coverage before the beads start flying.

The Business “Prenup”: Why Business Partners Need Life Insurance in February

Love your business partner? Protect your company with a Life Insurance-funded Buy-Sell agreement to ensure the business survives the unexpected.

Heading South? Insuring Your Mid-Winter Break Road Trip in February

Driving to find some sun this week? Check your roadside assistance and rental car coverage before you leave the driveway.

Spring Dreams, Winter Schemes: Updating Your Insurance Before Your Spring Renovation

Planning a Spring kitchen remodel? Learn why you need to call your insurance agent before the contractors arrive to ensure your project is covered.

Shadow or Spring? The Quirky Science and Folklore of Groundhog Day 2026

Will he see his shadow? Dive into the history and humor of Groundhog Day 2026 and why we still trust a rodent with our weather forecasts.

Stocked for Love: Protecting High-Value Valentine’s Inventory with Business Insurance

Is your Valentine’s stock protected? Ensure your business insurance accounts for the massive inventory surge happening in early February.

New Life, New Responsibility: Why a February Arrival Means Updating Your Policy

Welcoming a new family member this February? It’s time to move life insurance to the top of your to-do list to ensure your child’s future is secure.

Delivering Love: The Insurance Risks of Valentine’s Week Gig Work

Delivering flowers or chocolates for extra cash this Valentine’s? Make sure your car is actually insured for delivery work before you hit the road.

Tax Prep & Protection: Ensuring Your Home Office is Fully Insured for 2026

Prepping your taxes? Don’t forget to check your home office insurance. Your standard policy might not cover your professional gear or liability.

More Than Just a Sale: The Fascinating Evolution of Presidents’ Day

Why is Presidents’ Day on a Monday? Explore the history, the politics, and the trivia behind our mid-February celebration of national leadership.