How Your Life Can Be Easier and Cheaper with IoT

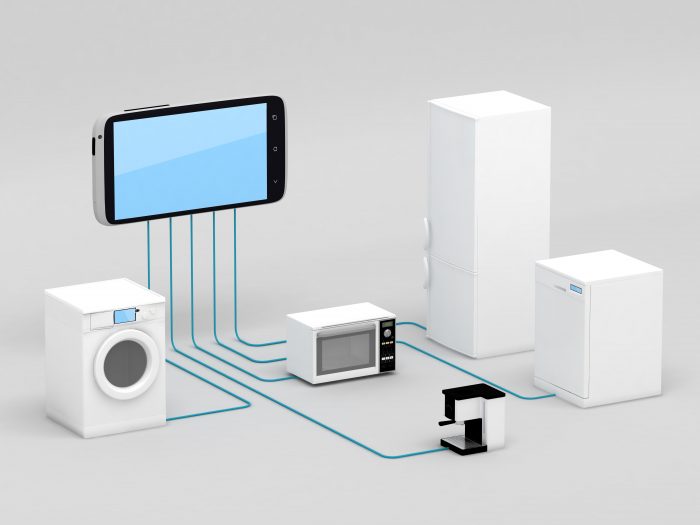

Internet of Things Concept – Home Appliances Connected To Smartphone

The way of today’s society is about living life in the fast lane and trying to get as much money as you can get your hands on—no, not you, sticky-fingered kleptomaniacs. Imagine devices that collect and transfer information instantly and can also save you money in the long-run. I’m referring to what’s known as IoT, or, the Internet of Things.

What “things”, you may ask? With such a broad title, what “things” are including the internet? It’s anywhere from home-security devices, to a toothbrush. What even is IoT? The Internet of Things uses a system of devices implanted with a technology that senses different aspects of that device’s surroundings and relays that useful information right to your cell phone. This technology can take the details of your everyday life and instantly send those facts to help you improve the quality of your life in many ways.

IoT includes devices that instantly measure carbon dioxide levels to prevent housefires via the smoke detector in your home, and doorbells that enable you to answer your door from your office space and have a face-to-face conversation from work. Also, the toothbrushes that measure the exact surface area of your teeth you are brushing, preventing too many trips to the dreaded-dentist’s office.

By having IoT connected to a security device in your home, with quick-response alarms equipped with built-in cameras that send notifications directly to your smart phone, the risk of emergency situations and burglaries in your home can greatly be reduced. When your agent notices you have preventative devices to protect your home, they are likely to reduce the cost of your home insurance.

Similarly, using an app on your smart phone enabled with UBI, or usage-based insurance telematics, to measure how quickly you stop and accelerate, your speed, even what time you’re driving, can result in discounts on car insurance. Some insurance companies use your driving record to decide how much your insurance is. This depends on how your driving is, rated on a scale from 80-year-old grandma, to absolute maniac. Just kidding, I think the scale involves more numbers.

This form of technology has begun to attach itself to numerous devices we use in our everyday lives, and it will only continue to impact our lives in the future, so let’s use it to our advantage.

By: Kaylynn

By: Kaylynn

Do you have questions about your insurance? Find an insurance agent near you with our Agent Finder

Search All Blogs

Search All Blogs

Read More Blogs

Shadow or Spring? The Quirky Science and Folklore of Groundhog Day 2026

Will he see his shadow? Dive into the history and humor of Groundhog Day 2026 and why we still trust a rodent with our weather forecasts.

Stocked for Love: Protecting High-Value Valentine’s Inventory with Business Insurance

Is your Valentine’s stock protected? Ensure your business insurance accounts for the massive inventory surge happening in early February.

New Life, New Responsibility: Why a February Arrival Means Updating Your Policy

Welcoming a new family member this February? It’s time to move life insurance to the top of your to-do list to ensure your child’s future is secure.

Delivering Love: The Insurance Risks of Valentine’s Week Gig Work

Delivering flowers or chocolates for extra cash this Valentine’s? Make sure your car is actually insured for delivery work before you hit the road.

Tax Prep & Protection: Ensuring Your Home Office is Fully Insured for 2026

Prepping your taxes? Don’t forget to check your home office insurance. Your standard policy might not cover your professional gear or liability.

More Than Just a Sale: The Fascinating Evolution of Presidents’ Day

Why is Presidents’ Day on a Monday? Explore the history, the politics, and the trivia behind our mid-February celebration of national leadership.

The Presidents’ Day Shutdown: Managing Risk During Holiday Closures and Sales

Closed for the holiday or open for a sale? A business guide to managing liability, employee pay, and property security during Presidents’ Day weekend.

A Presidential Legacy: Using Life Insurance to Fund Your Charitable Vision

What will your legacy be? Learn how to use life insurance to make a significant charitable impact this Presidents’ Day without depleting your current savings.

The Presidents’ Day Purchase: Navigating Insurance and Gap Coverage for Your New 2026 Vehicle

Buying a new car this Presidents’ Day? Make sure your insurance keeps up. Essential tips on Gap coverage and new vehicle replacement riders.

Water, Water Everywhere: Preparing Your Home Insurance for the Late-February Thaw

Is your basement ready for the thaw? Learn why standard home insurance doesn’t cover sump pump failure and how to add the right protection this February.